Property Taxes

TAX RATES

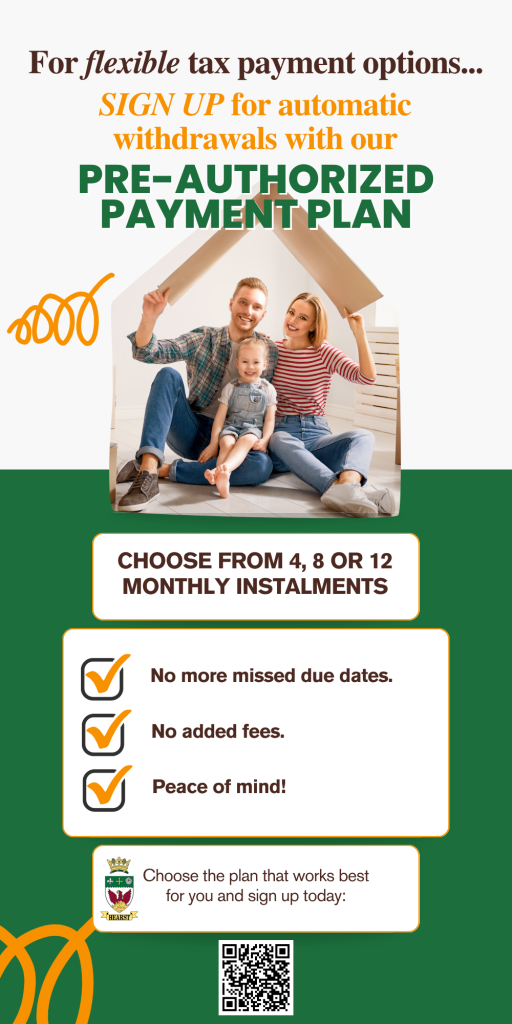

How to Register ?

- Complete and sign the Pre-Authorized Payment Plan Form.

- Attach your personal cheque marked “Void” or a Pre-Authorized Debit/Payment Form from your banking institution (forms printed from online banking applications are acceptable).

- Email the form and void cheque to receivables@hearst.ca, or mail/bring the form and void cheque to Hearst Town Hall, 925 Alexandra Street, Postal Bag 5000, Hearst ON, P0L 1N0.

Kyrah Richard, Tax Collector and Accounts Receivable / Accounting Clerk

705-362-4341 (1102)

krichard@hearst.ca

receivables@hearst.ca

Tax Collection and Billing Policy

(By-law No. 15-19, as amended by By-law No. 44-19)

Update your school support designation by June 1st, 2026 and be ready to cast your vote October 2026.

To ensure your correct school support designation is provided to Elections Ontario in time for the next municipal and school board elections on October 26, 2026, it should be reviewed and, if needed, updated by June 1, 2026.

While Elections Ontario maintains the Permanent Register of Electors in Ontario for provincial, municipal, and school board elections, MPAC (Municipal Property Assessment Corporation) is legislatively responsible for collecting school support designation information.

What is school support?

Whether you own or rent your home, your property is linked to a school board – even if you don’t have children or your children aren’t currently attending school. While you’re not required to make a designation, you do have the option to choose which school board you support. If you don’t make a choice, your support will default to the English-Public school board.

How to update school support designations

Property owners can change their school support designation online using MPAC AboutMyProperty™ or our online portal for tenants. To get started, choose the option that applies to you:

A step-by-step guide is available in English or French.

Please note: Registration may take up to 24 hours to activate.

You can submit a paper Application for Direction of School Support form in English or French and mail or email it to MPAC.

To learn more or update a school support designation, visit mpac.ca/schoolsupport.